Rental industry trends have been shifting in the past few years. So, it’s pretty hard to understand the game's rules today. Vacation rentals and large platforms that act as aggregators are a major part of these changes.

Airbnb, Booking, and Vrbo are just some giants allowing people to rent their homes or quickly find a suitable rental. These vacation rental statistics might help you better understand some basic concepts of this industry and the current situation in this market.

Editor’s Choice

|

Vacation Rentals Statistics: A Fresh Look

Online platforms such as Airbnb and Vrbo made vacation rentals more seamless than ever, allowing fast transactions and offering users numerous options at their fingertips. According to Statista, vacation rental revenue is expected to show an annual growth rate of 3.37%. This is a substantial boost for an industry deeply affected by the pandemic.

Look at the following vacation rental statistics to understand how the industry has developed recently.

Vacation Rental Industry Statistics

1. Global revenue in vacation rentals is expected to reach $94.34 billion in 2023 from $81.35 billion in the previous year.

(Statista)

The vacation rental industry should grow at a CAGR of 3.37% between 2023 and 2027 and reach a market volume of $107.7 billion by the end of the 5-year estimate.

Based on projections, the average revenue per user will amount to $116.7, and the US will be the highest revenue contributor globally. Further, the number of users is set to reach 0.9 billion by 2027, with a user penetration rate of 10.5% in 2023 and 11.3% by 2027.

2. With 24%, Spain is the number one country by user penetration rates in vacation rentals as of 2022.

(Stayfi)

Vacation rental statistics by location reveal Spain is the leader in user penetration rate. Two Middle East countries, Qatar with 22.4% and Kuwait with 21.7%, followed closely. Finally, two European countries, Italy and France, come next with a 21.6% user penetration rate each.

3. The US contribution to the global vacation rental market in 2023 is projected to be the largest, with $19.39 billion from $17.66 billion in 2022.

(Statista)

Looking at the vacation rental market data, we notice five countries stand out. According to vacation rental statistics, the leader in the market is the US, with the highest revenue of $19.390 billion from $17.66 billion in 2022. Also, China followed the US the previous year with the most significant revenue of $9.71 billion. Next are the UK ($4.37 billion), Japan ($4.30 billion), and Germany ($4.08 billion).

4. In March 2020, global bookings dwindled by 42%.

(iGMS)

The pandemic dropped the booking volumes everywhere around the globe. After March, it became even worse when the bookings reached the lowest number in April, falling by 72%. That said, June brought some better stats, but still much lower than 2019, as vacation rental statistics suggest.

5. Towards the end of 2020, customers canceled every two out of 10 bookings.

(iGMS)

The drop in bookings followed a sudden surge in cancelations. The cancelation rate in April increased by 70% compared to Q4 of 2019. In March and April, the number of new bookings was constantly lower than the number of cancelations. The situation slightly improved as the year went on.

6. Vrbo witnessed an 85% increase in demand for chalets year over year.

(Vrbo)

Vrbo is one of the oldest booking platforms for vacation rentals, up and running for 25 years now. Despite the effects of COVID-19, Vrbo statistics show that they registered an uptick in bookings for destinations near lakes and rivers, such as chalets and cabins. According to Vrbo’s 2022 Trend Report, the demand for chalets is increasing by 85% yearly.

7. There are 7 million active rental listings on Airbnb.

(Airbnb, HotelTechReport)

One of the giants in the world of vacation rentals, Airbnb, went public in 2020 with a value of $100 billion. Now, Airbnb has 7 million listings across 100,000 cities globally. Short-term rental market data suggests that, besides 24,000 tiny homes, these include:

- 3,500 castles

- 2,600 treehouses

- 140 igloos

Today, the platform gathers over four million hosts.

8. Airbnb’s market share increased, accounting for around 20% of the total rental industry in the US.

(Hospitable, Airbnb, Travel With a Plan)

Comparing Airbnb’s vs. Vrbo’s market share reveals Airbnb’s remarkable growth over the last 10 years. The total revenue of this company hit around $20 billion.

Although both platforms allow listing different properties, the main difference lies in availability, as indicated in vacation property rental market statistics. As opposed to Vrbo, Airbnb allows customers to list shared spaces. Moreover, compared to Airbnb’s 7 million listings, VRBO holds a portfolio of over 2 million.

9. 91% of property managers are interested in listing on several OTAs.

(BuildUp Bookings)

Aside from using different vacation rental software, many property managers extend their offers across several channels. Diversification in a competitive market can only add value to the company and maximize its revenue. According to short-term vacation rental statistics, 52% of managers diversified their offers and revenue channels in 2021.

💡Did You Know? The US property management has reached $120.72 billion in 2021, an all-time high. However, the overall revenue declined in 2022 to $115.4 billion. It is also expected to decrease further by 0.4% in 2023, going down to $114.9 billion. |

10. In the first quarter of 2021, Vrbo spent over ten times more on advertising in the US than Airbnb.

(The Wall Street Journal)

Vrbo’s market share seems to be skyrocketing, thanks to its aggressive approach to advertising in 2021. It has spent ten times more on the US market in the first two months of 2021 than its strong opponent, Airbnb, vacation rental statistics have demonstrated. The US online vacation marketplace has spent 53% of its Q1 revenue on marketing and sales. In Airbnb's case, it was less than 26%.

11. 38% of rental property owners planned to grow in 2021 and 2022.

(Buildium)

A survey of hundreds of small property owners indicated a growing number of those who plan to expand their portfolio in 2021-2022. Meanwhile, another 49% plan to remain the same, controlling their current properties, vacation rental investment statistics confirm.

12. Operations automation is a priority for 85.9% of hospitality professionals in the coming years.

(Operto)

Like many other fields, the vacation rental industry is going through technological shifts. So, implementing automation is the next step for most experts in the field. Besides many new property management solutions, rental sites, and tools, 82.4% claim that implementing keyless technology is the top goal, vacation rental industry statistics show. Keyless tech could replace front desks, enabling guests a seamless experience. In addition, this will remove the need for any assistance requiring physical presence.

13. Over 600,000 Americans use online platforms to rent their apartments, homes, or rooms to guests.

(iPropertyManagement)

Over 23,000 vacation rental companies operate in the US and around 115,000 globally. Vacation rental companies list 31.3% of all privately owned accommodation properties in the US. Yet, statistics reveal that most people use websites like Airbnb to book a vacation rental online. No wonder 600,000 property owners in the US use online platforms to rent out their apartments or homes to guests.

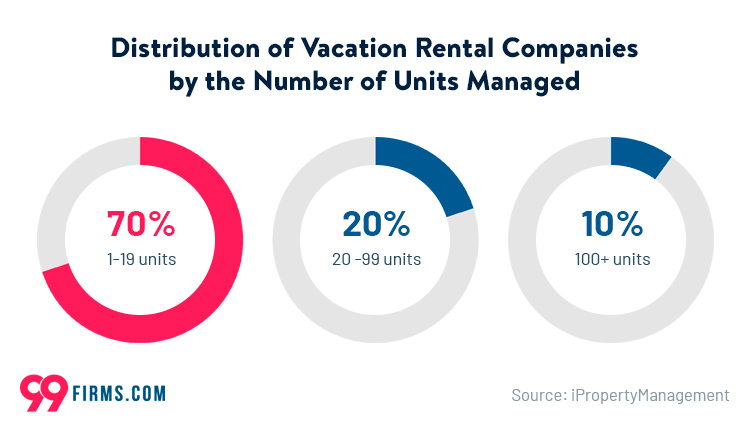

14. 70% of vacation rental companies are classified as small.

(iPropertyManagement)

Considering the vacation rental market size, the US, as the largest market, comprises diverse companies operating in the field. However, the majority are small and manage around 1-19 units. Some 20% are medium-sized and manage between 20 and 99 units. Finally, 10% are classified as large and handle over 100 units.

15. Domestic travel spending between 2019 and 2020 declined by 36%.

(iPropertyManagement)

Statistics confirm that the reduction in domestic travel spending was followed in the same period by the shrinking of the domestic vacation rental industry. International travel spending suffered even more, with 79%. As a result, the total economic output from the travel reductions was 42% or $1.1 trillion.

16. As of May 2021, 52,000 new rental units have been added to Airbnb and Vrbo.

(The New York Times)

The vacation rental demand came back strong in 2021. Although still not at the full capacity as before the pandemic, it was only 10% lower than a typical year during the same period. However, the companies claimed they needed many more hosts to keep up with the demand, vacation rental growth statistics indicate.

17. In April 2020, the vacation rental industry experienced an almost 50% unemployment rate.

(iPropertyManagement)

Covid-19 hit the vacation rental industry hard, especially since the travel industry supported 65% of the jobs lost in 2020. The sector employs 731,720 people, and almost 1.8 million work in the accommodation subsector.

The average accommodation worker earns around $20.51 per hour for 30.7 hours weekly. In the first three quarters of 2021, the employees’ hourly wage rose 8.3%. In the same period, working hours also increased by 5.5%.

Vacation Rental Trends

18. The online channel is the most prominent for booking vacation rentals in the US, with 76%.

(Statista)

Vacation rental data suggests online channel sales will grow even more in the next several years. For instance, by the end of 2026, it will rise to 80%. Alternatively, the current rate for offline channels (24%) will decrease to 20%.

Did You Know? Consumers trust online reviews a lot. Statistics show that 9 out of 10 consumers read online reviews before purchasing. The availability of reviews is one of the reasons more and more consumers prefer online platforms for purchasing goods and services. |

19. At the pandemic's start, the hotel occupancy rates dropped to 17.5%.

(HotelTechReport)

According to vacation rental statistics, hotels suffered far more than vacation rentals during the initial wave of the pandemic. Namely, their 77% high occupancy rate dwindled to only 17.5% YoY.

On the other hand, vacation rental occupancy rates managed to endure the blow much better, with studio and one-bedroom rentals registering 36.4% occupancy, compared to 66.3% in the previous year. Further, vacation rentals with two or more bedrooms had a low 32.6% occupancy rate compared to 60.6% in 2019.

20. In 2020, urban property demand plummeted by 38% due to the pandemic.

(Rental Scale-Up)

Unlike rural areas, short-term rental statistics show that urban and suburban properties suffered during the initial pandemic wave. However, trends indicate that by the end of 2022, the demand will increase by 33%. This will land the demand 17% below the end of 2019. Most of the growth will be concentrated around larger cities.

21. Demand for summer 2022 travel is up 25% relative to 2019.

(ABC News)

Travel plans are again soaring. So, the demand for travel during the summer months in 2022 is up 20-25% relative to 2019. Particularly, some destination resorts are reaching 40% higher demand over 2019. One of the most interesting destinations, in line with the vacation rental industry statistics, is Mexico (for travelers from the US). The number of Americans traveling to Mexico in March 2022 has increased by 20% compared to 2019.

22. Booking’s gross reservations grew 160% in 2022 to $19 billion.

(Yahoo Finance)

Despite the expectations and strong growth after a calmer situation with the pandemic, bookings failed to reach their forecasted number. Vacation rental property statistics show that its revenue doubled to $2.98 billion, but these numbers still lag behind the pre-pandemic levels.

In Q4 of 2019, for instance, the gross bookings hit $21 billion. Compared to analysts' predictions of 165.9 million rooms booked, the number on December 31st was 151 million. For reference, in Q4 2019, it was 191 million.

23. 38% of property managers reported more family bookings lately.

(Avantio)

Isolation took its toll, and many people in isolation for quite some time craved reunions with loved ones. Vacation rental data indicates that the primary motivation for 31% of travelers was spending quality time with their immediate family. Since 42% planned to travel in family groups, more suitable larger homes registered better results on the rental market, as evident from vacation rental statistics.

24. 57% of property managers cited increased bookings by guests planning to work while renting.

(Avantio)

Since introducing flexible hours and remote work, many have been free to combine work with travel. Namely, one in three people has been able to travel thanks to remote work. Over half of the surveyed managers have noticed more bookings by people who planned to stay longer and work.

38% had booked ‘flexcations’ to offer a different experience to their family and children. Moreover, the vacation rental industry statistics reveal that 67% of people would do it again.

What The Research Says A survey conducted by the Owl Lab shows that remote workers are 22% happier than their in-office counterparts. One of the reasons for this significant difference is the added flexibility remote work offers, especially in planning vacations. In fact, Vrbo’s 2022 Trend Report reveals that 44% of families are more likely to work remotely from a place that is not their home. |

25. Although 91% of vacation rental managers emphasized COVID-19 cleaning measures, 81% did not reflect them in their prices.

(AirDNA, Avantio)

Vacation rentals had to adapt to the new traveling measures more than ever. Among other things, travelers prioritized safety and cleanliness. Airbnb and Vrbo occupancy rates were directly associated with high cleanliness since both companies had the proper protocols. However, not many vacation rental managers factored these measures into their prices.

26. Over 75% of travelers prefer vacation rentals with flexible cancelation policies.

(Expedia Group)

Flexibility increases bookings — this is true before the pandemic and even more so now. Recent vacation rental industry statistics show that 77% of travelers would book a rental with flexible policies in place, while 49% of them consider it essential. Moreover, travelers search for ‘free cancelation’ more often when browsing.

27. In 2020, the average nightly rate for bookings in the US reached its highest at $202.5.

(iGMS)

Despite the expectations that the drop in bookings would force hosts to lower their rates, these jumped much higher as the initial wave passed. Namely, the hosts decreased their rates by 60% at the pandemic's beginning, but, as vacation rental statistics demonstrate, June came, and the prices went up.

28. Low commission structures are the most significant contributor (35%) to property owners using OTA.

(Rentivo)

OTAs are online travel agencies like Booking.com that rental property owners often use to expand their offers. The top deciding factors are low commission and the adoption of their booking rules (29%). Guest brand strength is also important, with 19%, and the ease of integrating and updating the listing (17%).

General Vacation Rental Statistics

29. 60% of survey respondents say they would book their vacations earlier than in pre-pandemic times.

(Vrbo)

The pandemic has severely disrupted the rental world. However, families didn’t give up entirely on their canceled vacations in 2020. After things get back to normal, they plan to travel more frequently. 65% of people plan to travel more than before, while 54% claim they are likelier to take their bucket list trips. Also, according to the Vrbo 2022 Trend Report, 60% of respondents say they would book earlier than before the pandemic.

30. In 2021, 88% of people in the US planned to travel, despite the restrictions.

(Avantio)

Namely, travel restrictions have crippled the world tourism industry and vacation property rental market, statistics indicate. Yet, in 2021, most people in the US planned to travel despite them. In other words, the restrictions didn’t stop them from dreaming about traveling. So, many property managers are now trying to ‘lure’ guests into advanced bookings to luxurious destinations; guests are increasingly asking for them too.

31. With 50.6%, men use vacation rentals more often than women.

(Statista)

Although vacation rental demand is higher among men, women aren’t falling much behind. Statistics show that the rate of women using rentals is 49.4%.

32. In the US, the 25-34 age group uses rental services the most.

(Statista)

According to vacation rental guest statistics, millennials are one of the most common users of these services. Following them, the age group 35 to 44 is the next largest user of rentals, with 25.5%. The age group 45 to 54 follows on the list, with 17%, and 18-24-year-olds, with 16.3%. Finally, the group using vacation rentals the least is 55 to 64 years, with 10.4%.

33. Only 29% of rental guests claimed to have a negative experience.

(ValuePenguin)

Although hotels are more popular than rentals in the US, a much higher percentage of hotel guests (44%) claimed they experienced a bad situation than the percentage of rental guests (29%).

34. Every two minutes, around 400 guests check in to Airbnb.

(Guesty)

According to Airbnb statistics, only 400 guests used this platform's services in its first year. Yet, ten years later, it became the number of check-ins every two minutes.

The company has come a long way in a short period, marking an increase of 26,280,000%. The platform is available in almost every country globally (97.95%). The only exceptions are:

- Syria

- North Korea

- Sudan

- Iran

35. Booking.com and Homeaway groups lead by the average length of stay, with 6.7 and 7.5 nights, respectively.

(Hosthub)

Vacation rental occupancy rates by the city indicate that the average length of stay for all vacation rental channels is 5.6 nights. Booking.com and Homeaway group are leaders by the length of stay metric.

36. Millennials were expected to spend $1.4 trillion on travel by 2020.

(Mendbnb)

In line with vacation rental statistics on millennials, this age group is more likely to rent out short-term vacation properties than book a hotel room. Moreover, they have expensive tastes, so 12% planned to stay in estates and villas, compared to only 6% of Boomers and 9% of Gen X. This group makes up 40% of those who travel for leisure and book online.

37. 81% of Gen Z travelers have stayed in vacation homes, condos, or cabins.

(Mendbnb)

Despite being too young to travel alone and use short-term rental services, some older members in this age group have significantly impacted the travel and rental industry. Here are the researchers’ findings:

- 35% of Gen Z travelers are most likely to travel with friends rather than close family or alone.

- Gen Zs prefer to spend more time in cities and urban centers (over 60%) than rural and suburban destinations.

- Most of them have already stayed in short-term rentals, and as the Gen Zs grow, so will the industry.

38. Vacation rental managers earn $44 for every $1 spent on email marketing.

Many marketing channels, like social media, content marketing, and paid search, could be beneficial and have some buzz moments. However, email marketing experts say email has proved to be the best conversion instrument.

It’s essential to keep growing the email marketing list to drive further bookings, vacation rental marketing statistics confirm. Another plus is that it drives these bookings directly to one’s site, decreasing dependency on OTAs and commission costs.

👍 Helpful Article Email remains an essential communication channel today and also a great marketing medium. Check out our reviews of email marketing companies and find the right solution for you. |

39. 43% of hosts renting out their primary residence manage it themselves.

(iPropertyManagement)

Apart from a larger number of people who handle leasing their homes alone, a percentage still prefer professionals. Of those renting out their secondary residence, 38% handle it. Vacation rental market data suggests that professionals manage 25% of second homes as rental properties. For reference, it translates into 2.25 million homes.

Conclusion

The pandemic has brought new uncertainty to the industry. The most recent updates in vacation rental statistics show the industry has already surpassed the pre-pandemic revenue size, indicating a complete recovery. With the help of various new technology solutions, there is much more to expect in the coming years.

FAQs on Vacation Rental Statistics

What is the world’s largest vacation rental search engine?

Airbnb is currently the largest vacation rental search engine based on the size of its hosts and listings (4 million hosts and 6 million active listings).

How does Airbnb work?

Airbnb is an online platform connecting property rental owners and people looking for accommodations. It is a listing search engine where property owners can post their rental offers while Airbnb collects revenue through commissions.

What is a host in a vacation rental?

A host in a vacation rental can be either the property owner or an agent managing the property. It can also be a management company the owner hires to manage their rental properties.

Sources

- Statista

- iGMS

- Airbnb

- HotelTechReport

- Statista

- ValuePenguin

- Stayfi

- Vrbo

- Hospitable

- Travel With a Plan

- BuildUp Bookings

- The Wall Street Journal

- Buildium

- Operto

- iPropertyManagement

- The New York Times

- Rental Scale-Up

- ABC News

- Yahoo Finance

- Avantio

- AirDNA

- Expedia Group

- Rentivo

- Guesty

- Hosthub

- Mendbnb

- Rented